USDX: The FOMC minutes and Friday's PCE data will decide whether the dollar can hold support and start a recovery toward 99.10, or whether a break of 96.90 will open the way to a new phase of weakness.

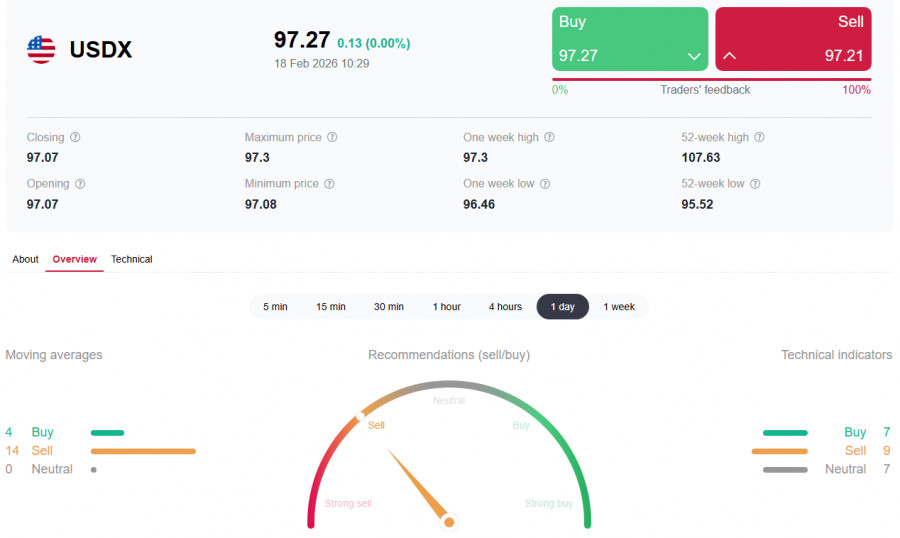

The US dollar shows restrained gains in the first half of today's session. The dollar index (USDX), building on a bullish impulse that began last week, is testing 97.30 for an upside break as it attempts to return toward yesterday's and the six-day high near 97.50.

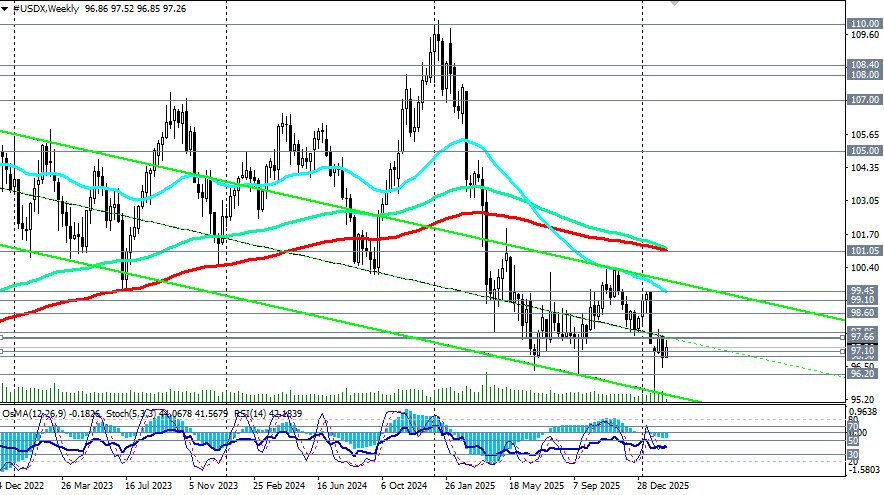

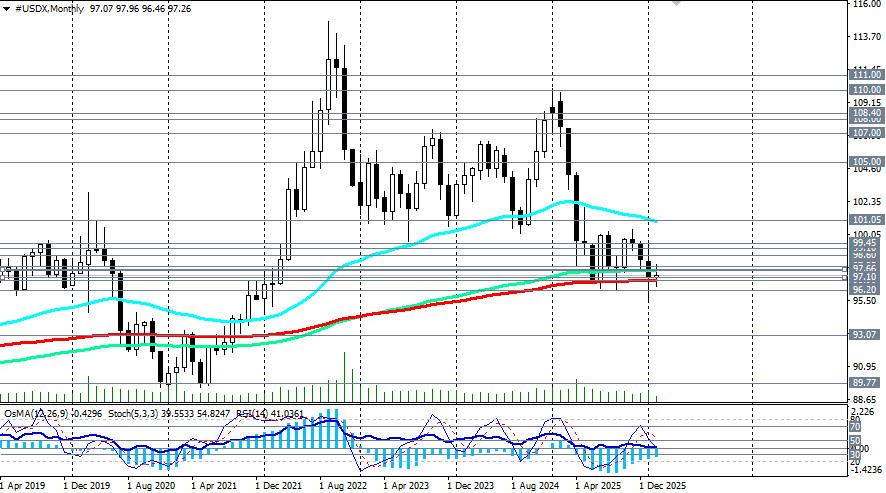

After a difficult period following a nearly 9.5% decline in 2025 (its weakest annual performance since 2017), the USDX is consolidating near the critical strategic support at 96.90. Today's situation is a contest between renewed expectations for Fed easing and technical levels that will determine the dollar's path for months ahead.

At the same time, it's clear that the dollar needs fresh drivers to sustain an advance, and market participants are looking to new macro releases and the FOMC minutes from the January meeting (due at 19:00 GMT).

Inflation and the labor market The key driver behind investor optimism was last Friday's inflation print: the year?on?year CPI slowed from 2.7% to 2.4% — the lowest since May 2025 — and monthly CPI fell to 0.2% from 0.3% (versus expectations of 2.5% and 0.3%). Core CPI edged down to 2.5% y/y from 2.6% and rose 0.3% m/m.

Those figures mark an unexpected slowdown in inflation, driven mainly by lower rent and energy costs, and markets repriced the likelihood of the Fed easing accordingly.

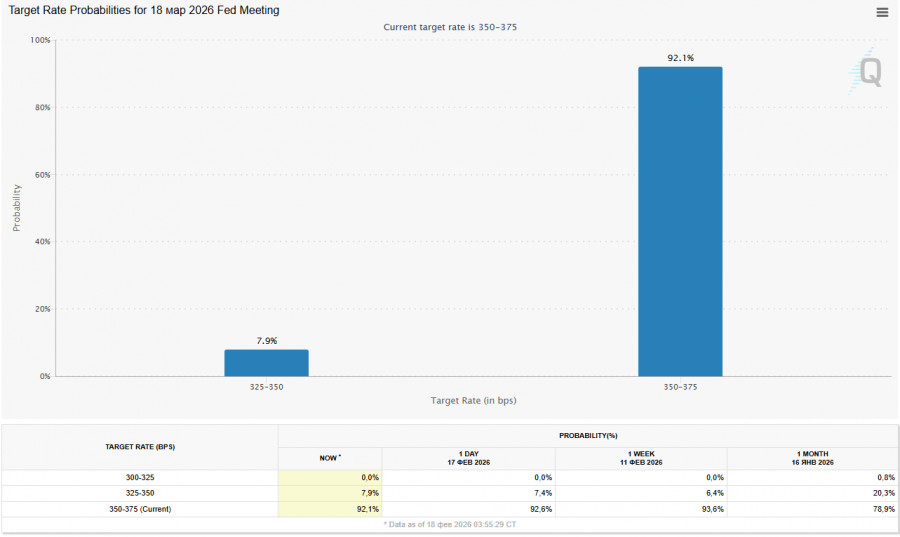

According to the CME FedWatch Tool:

- The probability that the policy rate will remain at 3.50–3.75% at the March meeting (March 18) is about 92.1% today (up from 81% a week earlier).

- The probability of the first cut occurring in June is roughly 52%.

- Investors now price in two or even three rate cuts in 2026.

Chicago Fed President Austan Goolsbee said there may be several additional rate cuts this year if inflation continues to slow toward the 2% target, but he stressed he needs 6–8 months of confirming data before acting. Not all Fed officials are equally optimistic: Governor Michael Barr signaled the Fed will likely hold rates "for some time" and wants to see sustained evidence of falling inflation before considering cuts.

On the other hand, the January jobs report released on February 11 surprised on the upside: payrolls rose by 130,000 (the strongest gain in over a year) and unemployment unexpectedly fell to 4.3%. That strengthens the labor market resilience argument and complicates expectations for imminent rate cuts.

Political factor: the nomination of Kevin Warsh Kevin Warsh's nomination for Fed chair brought some stability to expectations. Warsh's reputation as a balanced leader who is not in favor of additional Fed asset purchases eased fears of excessive easing and threats to Fed independence.

After the nomination, concerns about a sharp dollar collapse receded. However, the confirmation process in the Senate could become contentious over questions of Fed independence, adding political risk. Markets have pared some bearish dollar bets, but investors are still willing to pay for protection against sharp moves in either direction.

Geopolitical backdrop: the Iran factor Geopolitical tensions add another variable. Iran temporarily closed the Strait of Hormuz for military exercises amid renewed nuclear talks with the US, creating upside risk for oil and supporting demand for the dollar as a safe haven. At the same time, reports that basic principles are being agreed upon in talks have tempered dollar strength somewhat.

Analysts' views: a split outlook

- Bullish view: Dollar appreciation into at least Q3 2026 versus the euro, CAD and GBP, supported by improving US growth prospects, steady foreign demand for U.S. equities and bonds, and a less aggressive policy stance before the midterms. Much of the negative sentiment, this view argues, is already priced in.

- Bearish view: The dollar is unable to mount a sustained advance and will decline through the year as the administration prefers a weaker currency.

Key events ahead

This week, markets will focus on:

- 18 Feb: FOMC minutes — searching for clues on the timing and extent of rate cuts.

- 19 Feb: weekly jobless claims, trade balance and Fed speakers.

- 20 Feb (key day): Q4 2025 GDP and the Fed's preferred inflation gauge, core PCE. A cooling PCE will keep rate?cut expectations alive.

Technical picture

Technically, the USDX is balancing at strategic support 96.90 (monthly 200?EMA). A break below this level would propel USDX into global bear?market territory, paving the way for further declines amid lower inflation, geopolitical risks and potential policy shifts. The index trades below the daily and weekly 200?EMA, confirming a bearish bias. Technical indicators also show persistent selling pressure.

Conclusion

The USDX stands at a critical junction. The 96.90 support is the last bastion before a broader bear market. Fundamentally, the surprise slowdown in inflation has opened the door to Fed easing, but a resilient labor market and cautious Fed commentary (Barr, Goolsbee) are restraining immediate action.

Kevin Warsh's nomination has temporarily stabilized expectations, but the Senate confirmation process could introduce new risks. The coming days will be decisive: the FOMC minutes and especially Friday's PCE will determine whether the dollar can hold its strategic support and begin a recovery toward 99.10, or whether a break below 96.90 will usher in a new weakening phase. For now the balance of technical and fundamental forces warrants caution, but the final verdict will come from the inflation data and the market's reaction to it.